If you’re ready to take self-custody of your crypto assets, you’ll need to choose a crucial piece of technology: a crypto wallet. In this article, we’ll explain how crypto wallets help you safeguard your on-chain credentials and crypto assets. We’ll also explore the two major types of crypto wallets to help you decide between the superior security of a hardware cold wallet and the streamlined convenience of a software-based hot wallet.

What is a Crypto Wallet?

Simply put, a crypto wallet is a tool that helps you access the blockchain accounts that hold your crypto assets. An important distinction between a traditional, slip-in-your-back-pocket cash wallet and a crypto wallet is that a crypto wallet doesn’t actually “contain” currency.

A crypto wallet stores encrypted information that identifies your account on a blockchain and its access credentials: the public key address and your private key.

The records of what cryptocurrency and NFTs your account holds are stored in the public blockchain ledger. A crypto wallet makes it easy to view the digital assets and balances recorded in the ledger and to approve on-chain transactions.

Crypto Wallets Provide Self-Custody

It's possible to buy, hold, and sell popular cryptocurrency tokens without using a non-custodial crypto wallet. Centralized cryptocurrency exchanges, such as Coinbase, FTX, and Binance, allow you to buy many popular crypto tokens which they’ll hold in an account for you . This kind of an account is defined as a custodial hot wallet, i.e., a software-based hot wallet in which the funds are managed and held by the exchange. This kind of wallet gives the user partial custody of their assets because their private keys are stored on the servers of the institutional intermediary and therefore, not fully in the user’s control.

These firms operate much like banks, maintaining custody of your assets and storing your account records in their private data centers. You can access your account with a password to request transactions. Like banks, custodial exchanges and brokerages also set the rules and terms on what assets you can buy, the types of transactions you can do, how and when you can make them, and what you’ll pay for their services.

Self-custody enables you to take direct control of your crypto assets and enter the more transparent and flexible world of decentralized finance (DeFi). With self-custody, the records of your ownership and transactions are recorded in the blockchain’s globally distributed public ledger, not in a corporate data center.

Your account is identified by a unique public key, or wallet address, a long string of randomly generated letters and numbers. The “password” for accessing your blockchain account is a different unique set of randomly generated characters called a private key. At its core, what self-custody means is that you have sole control of the decisions and the keys for executing blockchain transactions involving your crypto assets.

A crypto wallet is the essential piece of technology for easily and securely managing the self-custody of your crypto assets.

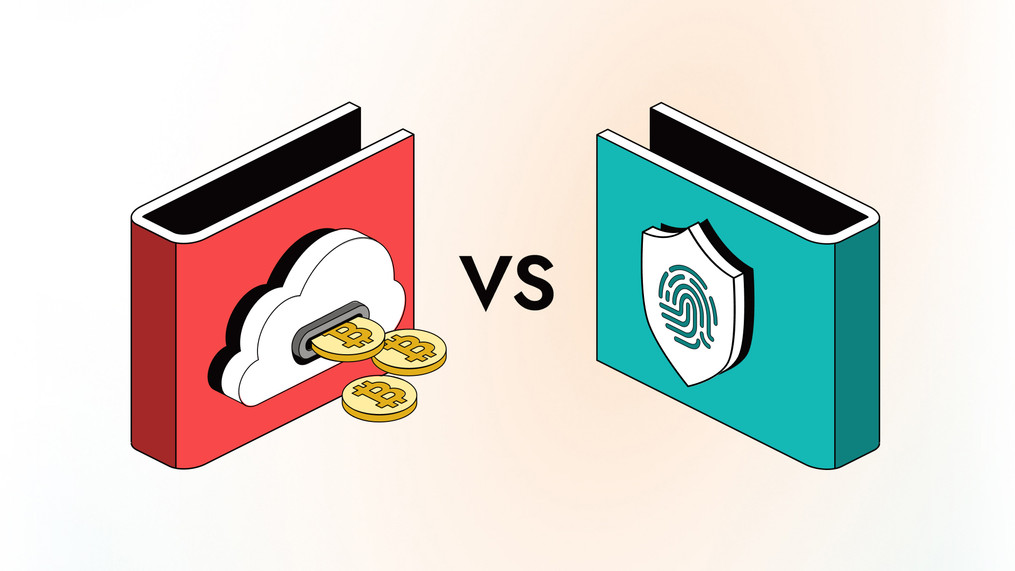

What are the Different Types of Crypto Wallets?

There are two main types of crypto wallets: software-based and hardware-based. Let’s take a closer look at the differences – and the trade-offs – between them.

Software Wallets: aka Hot Wallets

Software wallets, also called hot wallets, are computer applications, mobile apps,or browser extensions that store your encrypted account credentials, display asset balances, and enable you to approve on-chain, smart-contract transactions.

Hot wallets get their name from having a continuous live connection to the Internet and blockchain networks. This makes them convenient to use. Simply connect to an exchange, dApp, or DeFi protocol, and you can complete a transaction in seconds.

Hot wallet developers are steadily improving the features, interfaces, and user experiences of their software, making crypto transactions easier to understand and execute.

It’s easy to confuse custodial and non-custodial hot wallets. In the case of custodial hot wallets (in which an exchange or firm maintains access to and control of your private keys), you can easily lose access to your funds when the exchange becomes insolvent.

True ownership of your assets is all about access to and control of your private keys: self-custody (non-custodial) wallets, whether hot or cold, ensure true crypto ownership by ensuring constant access to your funds and control of your private keys.

Unfortunately, custodial hot wallets also have security-related drawbacks. Constant connections to the Internet expose hot wallets to the full range of hacks, attacks, viruses, exploits, and theft that plague other parts of our connected lives.

In addition, some wallet apps and browser extensions remain signed in on devices for extended periods. If thieves get access to that device, they could instantly transfer the owner’s assets to their own anonymous wallet.

Because hot wallets are software-based, they can also have bugs or exploits hiding in their code that only come to light when clever cyberthieves discover them. And since crypto is valuable, some of the most brilliant and diabolical technical minds out there are tirelessly searching for new ways to steal it.

Hot wallet advantages:

- Cost – most software wallet apps and extensions are free

- Ease of use – instantly ready to connect to dApps and approve transactions

- Timeliness – up-to-date account balances displayed in the app

Hot wallet drawbacks:

- Exposure – Internet connectivity leaves them open to online attacks

- Code risk – software code can contain vulnerabilities or exploits

- Crime targets – scammers and thieves see hot wallets as easy prey

Hardware Wallets: aka Cold Wallets

Non-custodial hardware wallets, also called cold wallets or cold storage wallets, are physical pieces of technology that store users’ encrypted blockchain credentials offline.

They are inherently more secure from cyberthreats than hot wallets because they only connect to computers or mobile devices when the private keys are needed to access accounts and authorize transactions. Beyond the moment of transaction, cold wallets remain completely unconnected to devices and networks.

Moreover, since hardware wallets are physical objects, you can increase security by locking yours away in a safe, lockbox, or safety-deposit box. Many are small, making it easy to take your crypto credentials with you, like some refugees of the Russia-Ukraine war were recently able to do when they were forced to flee the country.

Cold wallet advantages:

- Better security – air-gapped storage of private keys

- Physical item – secure it in a safe or lockbox

- Transportable – easy to take encrypted blockchain credentials with you

Cold wallet drawbacks:

- Need to purchase – unlike a software wallet, it can’t just be downloaded

- More steps – users needs to complete more steps to connect and approve transactions

- Physical item – can be lost or destroyed (but it’s important to note that the data can be recovered)

Selecting the Right Type of Crypto Wallet

So, which of the two types of crypto wallets is better? Your answer will likely depend on how active you are in crypto and Web3, the value of the assets you own, and your tolerance for risk or inconvenience.

In practice, most savvy crypto investors use both. A hot wallet is their tool of choice for lower-value, everyday transactions. But when it comes to ensuring self-custody and safeguarding valuable tokens and NFTs, experienced investors typically rely on the superior security of a cold storage wallet.